Booming Airline Interior Sector Consolidates

Recently in Aircraft Interiors International‘s 2015 Showcase Edition, Jon Lundberg and Ben Bettell of Counterpoint Market Intelligence recently reviewed the state of the airline cabin interiors industry, a $10.5bn market sector, that they forecast will expand faster than others sectors.

They note that the civil airliner industry is seeing a period of strong growth with build rates reaching record levels. Consequently the supply chain is benefiting, with many sectors achieving impressive growth. The airline interiors sector is also benefiting from cabin upgrades due to strong competition between airlines to compete on the quality of their passenger experience.

https://www.youtube.com/watch?v=tvnVRoGcJ1w

Even in the short haul sector airlines are investing. In June 2014 Keith Williams, British Airways’ executive chairman, said:

The short-haul landscape has changed enormously in recent years. To stay competitive and keep offering customers choice, great fares and great service, we are giving our cabins a radical makeover. There will be a new look, but the traditional British Airways’ comfort, elegance and value will remain.

The need to provide passengers with restricted mobility more equitable facilities is also important:

Another reason for this is simply to reduce weight.

Meanwhile, Aerossurance previously looked at top end helicopter VVIP interiors in September. Airbus Helicopters has been developing a new cabin fit for the EC225 using a more comfortable Fischer seat with open headrests, which we had the chance to view a few months ago at the Airbus facility in Aberdeen.

Counterpoint forecast that the compound annual growth rate for the interior sector will be 5.5% over the next 10 years (compared to 3.7% for engine parts and 2.7% for aerostructures).

There has also been a lot of consolidation in the sector too, with Counterpoint highlighting two rapidly growing companies::

- B/E Aerospace has acquired 23 other interior companies since 1987 (three this year alone: Emteq, Wasp and Fischer)

- Zodiac Aerospace had acquired 17 companies since 1992 (including Greenpoint Technologies this summer)

Counterpoint argue there is still a role to play for smaller companies, but they will have to convince their customers of their financial stability and long term prospects.

UPDATE December 2014:

As a further illustration of the growth in this sector: Zodiac seat delays underscore broader constraint in supply chain, affecting Boeing 787 deliveries. Airbus deliveries have also been affected: A380 delays come as galley engineering constraint is apparent. One reason for the slight delay in the delivery of the first A350XWB is said to have been to similar Buyer Furnished Equipment (BFE) issues.

One way to shorten time to market is collaboration and slicker certification: Airframers, suppliers collaborate to shorten lead times for seats:

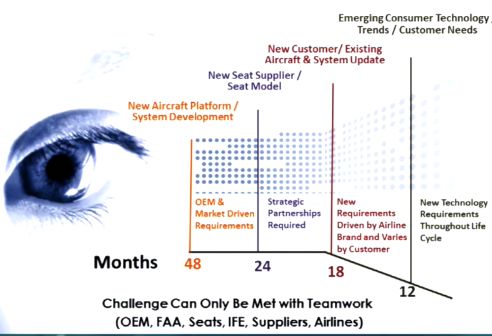

Consumer technology changes every six to 12 months, but the lead times required for bringing new aircraft seats with inflight entertainment systems to market can actually take years due to a variety of factors, including the lengthy and convoluted process for clearing Head Injury Criterion (HIC) certification. The result is that, by the time an aircraft enters revenue service, its integrated IFE/seats can look and feel somewhat outdated to passengers.

Product Development Lifecycle (Credit: Thales)

Now the seat makers, IFE vendors and airframers including Airbus and Boeing are working together as part of a new Society of Automotive Engineers (SAE) aircraft seat committee to streamline testing and make certification easier. This in turn will help the industry keep pace with the rapidly changing consumer environment, and better support airframers’ ramp-up of aircraft production.

UPDATE 14 September 2016: Aircraft Interiors: Taking Product Innovation To The Skies

For expert advice you can trust on aircraft interior specification and certification, contact Aerossurance: enquiries@aerossurance.com

Follow us on LinkedIn and on Twitter @Aerossurance for our latest updates.

Recent Comments