CHC FY2015 Results & Restructuring

On 29 June 2015 CHC Group (NYSE: HELI), the parent company of CHC Helicopter, reported on Fiscal Year 2015 (to end April 2015). The headlines are:

- Full-year revenue down 3% to $1.7 billion with a net loss of $795 million (compared to $1.78 billion and a net loss of $171 million in FY2014).

- Q4 revenue of $374 million and a net loss of $119 million (compared to $453 million and a net loss of $26 million in Q4 FY2014).

- Restructuring charge of $77 million booked in Q4 in response to the oil and gas industry downturn.

- Adjusted EBITDAR excluding special items down 2%.

- $320 million of long-term debt retired in FY2015; annualized interest expense reduced about $30 million.

- New $145 million asset-backed loan facility which it was stated will provide additional financial flexibility.

- Full year GAAP net loss per share of $11.17; adjusted EPS loss of $1.82.

On 30 June 2015 the company staged an investor webcast with new CEO Karl Fessenden and outgoing CFO Joan Hooper and an accompanying presentation.

The annual filing to the Securities and Exchange Commission (SEC), the 10K, is due later this week.

Safety

The 5 year rolling accident rate is 0.38 per 100k flying hours, unchanged since last year (see presentation page 4).

A footnote states this data includes G-CHCN in 2012 and G-WNSB in 2013. While total flying hours in the period are not disclosed, based on recent SEC filings, CHC has been flying an average of about 160k FH per annum, so 0.38 equates to 3 accidents. There was also a ramp accident to VH-LAG in 2011.

CHC has made what would, traditionally, have been a sensible choice and compared their performance to the last IOGP (formerly known as OGP) aviation report (1.8 per 100k FH for all offshore helicopters and 0.8 per 100k FH for twins).

Unfortunately, while for many years IOGP produced annual reports on aviation accident rates in the oil and gas sector, the last IOGP report was published in 2009, and covers data up to the end of 2007. So their 5 year average covers the truly dreadful year of 2003 through to 2007 but nothing more recent.

It is disappointing that current safety benchmark data is not currently available in the public domain.

There is other data that could be used in comparison. For example from the Helicopter Safety Advisory Conference (HSAC) for the Gulf of Mexico, which we have discussed recently, where the accident rate for 2010-2014 was 1.22 per 100k FH and the dreadful UK performance of 1.62 per 100k FH from the Feb 2014 UK CAA CAP1145 report for 2008-2012 (combining flight hours from Annex C Table C6 and the 6 accidents from Appendix 1 to Annex C). However, neither is an ideal comparison baseline for a global helicopter company.

CHC was a founder member of industry safety organisation HeliOffshore, along with Babcock, Bristow, ERA and PHI. HeliOffshore held their inaugural conference in May.

Operational and Financial Data

Aircraft availability (of operational aircraft not undergoing scheduled maintenance) has improved (page 8). In FY2014 it slowly increased from a poor 82% up to 90% and has been pretty consistent at around 94% in FY2015. CHC do not state what proportion of their fleet is operational.

In early remarks there was positivity about the Operations Control Centre in Dallas and IT standardisation initiatives but also for a change so that the Regional Directors now report to the CEO.

The $77 million restructuring cost (page 9) was very roughly 50/50 split between the redundancy costs of a 12% headcount reduction and lease costs for aircraft that are currently off-contract, not expected to be re-contracted but not due to come of lease until 2016 or 2017. Although CHC declined to identify the aircraft off-contract but still on lease, a scan of the fleet list would suggest that if they are ‘old technology aircraft’ (see below) they are highly likely to be predominately AS332L/L1/L2.

An asset backed loan facility signed in recent weeks provides an additional $145 million of liquidity. In discussion it was stated that this has not yet been used but it was touted as something that will give the company increased flexibility, in particular to purchase aircraft rather than lease. As CHC has been a significant lease customer in recent years, this does pose interesting questions on the current lease market.

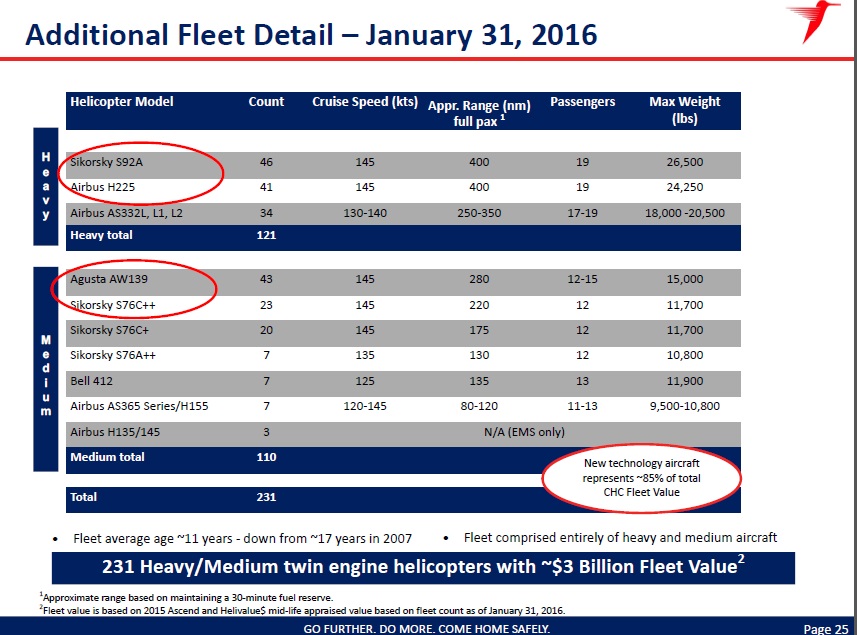

The average CHC aircraft age is down from ~17 years in FY2007 to ~10 years in FY2015 (page 22), and the fleet of 231 aircraft has a value of $3.1 billion (page 24). It is stated on page 22 that ‘new technology aircraft’ account for ~85% of fleet value (compared to 79% in FY2014). New technology in this context, according to page 25, is the S-92A, EC225, AW139 and the older S-76++ (150 aircraft in the fleet of 231, compared to 138 of 236 at the end of FY2014). However only 7 of those 150 aircraft are owned (albeit up from 5 in FY2014).

These 231 aircraft equate to a ‘heavy [helicopter] equivalent’ of 160. The annual revenue for an heavy equivalent rose from $6.8 million in FY2011, to $8 million in FY2012. It has remained in the region of $8.8 million in the last 3 years (broadly consistent with Bristow data for their ‘large aircraft equivalent’).

The largest helicopter operating revenue drop was in the Eastern North Sea (i.e. Norway), down 12% from FY2014 (page 26), compared to 4% overall. A loss of Statoil contracts was mentioned in the question and answer session.

It was denied that CHC were actively pursuing the sale of their MRO business HeliOne.

The Market

The market reaction has not been good:

UPDATE 5 May 2016: CHC Group Files Voluntary Chapter 11 Petitions to Facilitate Restructuring and Position Company for Long-Term Success

Customers, suppliers and other stakeholders can find additional information about CHC’s reorganization at www.chc.ca/restructuring

UPDATE 9 May 2016: CHC Group Receives Court Approval of “First Day” Motions to Support Business Operations. CHC say:

The Court approved motions giving CHC authority to, among other things, provide employee salaries, healthcare coverage and other benefits; access its cash and cash collateral and continue its current cash management system; and maintain and honor customer deposits in the normal course throughout the court-supervised restructuring process.

CHC expects day-to-day operations to continue without interruption throughout the process. The Company expects to maintain sufficient liquidity throughout the restructuring process to maintain its continuing business operations.

Among the information revealed in that first day motion is that (emphasis added):

The Debtors [CHC] have undertaken to accelerate their fleet replacement strategy in exiting from non-revenue generating aircraft and five older technology helicopter types, in order to first meet their customers’ demands for newer technology helicopters and then reduce the number of different helicopters types in their fleet. The Debtors expect to reduce their fleet to approximately 75 aircraft by 2017, with approximately 90 aircraft to be returned in the next sixty (60) days.

This is a dramatic reduction considering in January 2016 the company had 231 aircraft, 67 owned and the rest leased (the same number as June 2015):

While they make the point that some of these are legacy types the 90 consist of:

The near-term returns include approximately 16 Sikorsky S-76, 18 Airbus AS332, 16 Sikorsky S-92, 20 Airbus H225, 1 Airbus EC155 and 19 AgustaWestland AW139.

In other words: approximately 32% of their S-76s, 52% of their AS332s, 35% of their S-92As, 50% of their H225s and 44% of their AW139s.

They also say:

CHC believes it is likely that a substantial number of additional helicopters and related equipment will be retired in the future.

The application is to allow the termination of their lease obligations and the return of aircraft to the lessors, with some parts of the applications made likely to alter the normal contracted return conditions.

This will no doubt have a major impact on the lease rates and market value of similar types.

More hearings are set for 6 June 2016.

UPDATE 24 March 2017: CHC Group Successfully Emerges from Court-Supervised Restructuring

CHC’s Plan and Disclosure Statement as well as other information related to the restructuring proceedings are available at www.kccllc.net/chc.

Additional information is at www.chcheli.com/restructuring.

Recent Comments